First published in VS Magazine February 1990

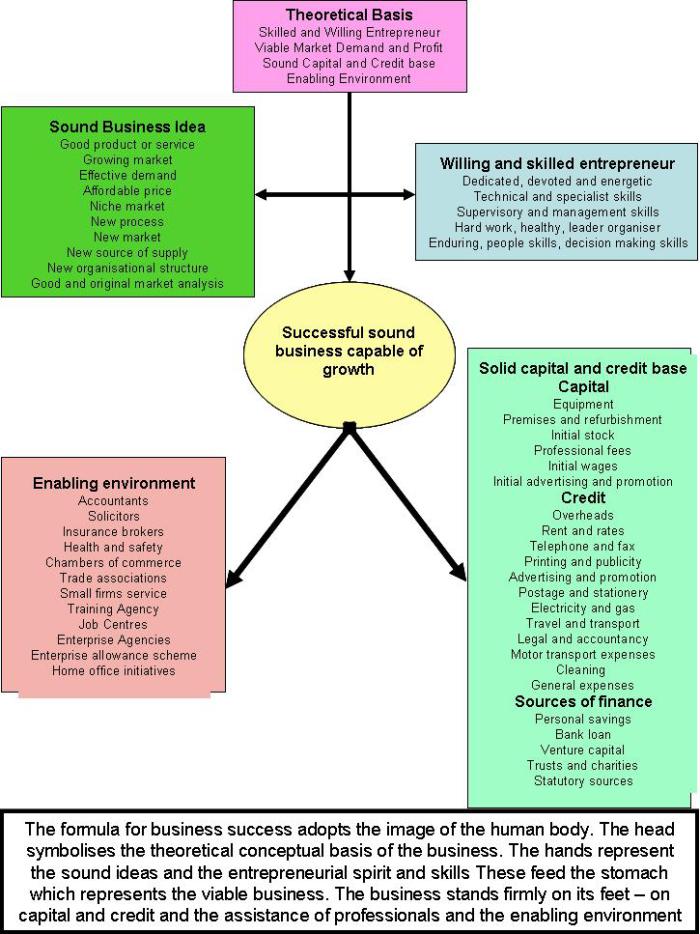

Some people think that you just get an idea, a bank loan and then you are in business. This may be true for a few people, but for the majority of us it takes a little longer. Ade Sawyerr looks at the strategies that you need to apply when you say ‘I want to start a business, and mean it’.

TO START

• You need to have a sound idea of the product or service you want to supply.

• There must be a viable market for which demand is likely to grow.

• You need to be committed, dedicated and willing, with relevant technical and management skills and experience which can be applied to the enterprise.

• You should have a solid capital base and avenues for credit should be available to you,

• You need to get information on the various support initiatives, training courses, management and technical assistance packages available which help to create an enabling environment and without which many ventures will fail.

SOUND Business IDEA

• You should aim to set up business for which a large and growing market exists and in which you can combat present and future competition. The idea need not be new. New ideas tend ‘0 require a lot of capital and work to stimulate demand.

• To succeed all ventures must have a good product or service targeted at a market with effective demand.

• You must introduce some uniqueness into your business enterprise, and keep abreast of changes by introducing new products and services. Remember that a large proportion of our earnings are spent on products which have been up-dated and re styled over the past five years. Successful businesses earn roughly half their profits from these products.

• Always try to reach new markets, look for new Sources of supply and develop new production processes.

MARKET ANALYSIS

• Market analysis will enable you to calculate all risks and make informed decisions, based upon thorough research. Ask questions in a systematic way to find out how feasible your idea is. You need 10 know what factors influence demand, supply and prices; what the channels of distribution and profit margins are and how your competitors are faring. To obtain his information you will need to speak to potential customers and some suppliers.

• Design a questionnaire to conduct a small survey and analyse the results yourself. Published statistics and reports will tell you about the industry, but only good original research will l you exactly what you need to know about your business idea e.g. where your customers are located, how many of your product they will buy, and how often at what price and what they like or dislike about what you are planning to offer. This will give you a clearer idea of the viability and potential of your venture.

The ENTREPRENEUR

• You must have absolute confidence and belief in yourself. Do not allow friends to distract you from your vision. In addition 10 your energy and enthusiasm you should also be (or employ) an expert in the enterprise. If the business is to thrive you should be prepared to adopt sophisticated management strategies. Successful business people are good workers, and organisers, they love people and are in good health. They are also patient enough to endure through all the initial teething problems faced by most enterprises.

Start Up Costs

• CAPITAL

Initial Finance Before you attempt to make contact with funding bodies you will need to estimate how much money will be needed for the first three months

The CAPITAL COSTS that you incur at the start will consist of

CAPITAL EQUIPMENT -T he machinery you require for use in production and

PREMISES- the premium you pay for getting the ease. Renovation, refurbishment, fittings, fixtures and furniture too, all form pan of the initial capital needed, In addition to these generally termed

FIXED ASSETS normally spent prior to the start-up, you will also need to make allowances or the following.

Professional Fees: monies paid to. Surveyors, solicitors, accountants, business consultants and insurance brokers.

• Initial Wages: If you intend to employ people you will need to set aside at least three months wages for each employee.

• Initial Stocks: You need not buy stock in bulk initially, because you do not really know how well the product will sell at the start.

• Advertising and Promotion: You will, need to make potential customers aware of your business and sustain their interest in it. A fair amount of money will need to be budgeted for this because marketing is of vital importance to a new business.

Operating COST

• You need lo estimate how much money you will spend during the year art when you will spend it. Calculate

OVERHEADS like, rent, rates, telephone, tax, printing, publicity and promotion, postage, stationery, electricity, gas, transport, legal, accountancy, cleaning, and insurance. A useful rule of thumb when estimating how much money you wit need is to work out the budget for capital items and add three months overhead expenditure. Generally, short-term funds are financed by overdrafts and credit from suppliers.

RAISING FINANCE

• Monies needed for capital expenditure can be raised from loans, lease purchase, mortgages and venture capital funds as well as from private backers and sleeping partners.

• Personal Savings should be accumulated to invest in your business. It encourages other lenders and backers if you have staked your own capital.

• Partners and Backers should be sought. Interest friends and relatives in your project before you approach the bank; it encourages those who do not know you to take you seriously, if you can prove hat people who do know you have invested in your enterprise. This source is useful for initial operating expenses.

• Bank Loans are for people with security. You will need to present a business plan which states the reasons, duration, security and repayment terms for the loan. Expect the bank to require you raise at least half of the required capital from other sources.

• The Government Loan Guarantee Scheme guarantees up to 70 per cent of your loan up to £100,000 for which you pay two-and-a-half percent above the bank’s lending rate as a fee this fee is spread over the period of the loan; this is intended for would-be business people without security and with very little capital.

• Venture Capital is suited for those who want to give up some of the equity in their new company. Most venture funds are looking for people with proven management and technical skills; however, they are often interested in new ideas. The British Venture Capital Association, 3i. Venture Capital Report and Business Opportunities Digest are among the sources of venture funding.

• Trusts and Charities are involved in assisting new businesses. They include the Princes Trust Tudor Trust and Rowntree McIntosh. More information can be obtained from your local Enterprise Agency.

• Local Authorities are interested in encouraging new business by providing grants for rent and refurbishment of premises.

• Your local authority may have Business Advisors working Wit their Economic Development Units, who will he able to advice and assist you with your business plan

• They will also inform you what financial assistance the Council can provide in the form Feasibility Studies and marketing Grants. Some local authorities also provide special grants for cooperatives and social businesses

• You will need to shop around for the right combination of funds, – usual a mixture of the above.

THE BUSINESS PLAN

• When raising funds it I important to prepare a business plan which tells the potential financiers how you will make business a success. You have to show your fund requirements, initial capital and on-going cash requirements, and establish a projection of profitability.

• All in all, a lot of background work needs to be done before you can raise money. And remember that many good ideas remain just that, because the proposer does not have any money to invest and cannot raise the necessary capital from outside sources.

Enabling ENVIRONMENT

• Businesses thrive when there are mechanisms of support and when both central and local government provide the necessary encouragement and when there are enough institutions and financial brokers ready to help.

• Important sources of assistance include: The Department of Trade and Industry Small Firms Service which offers counselling for start-ups through enterprise counsellors. You can get in touch with them through Freephone Enterprise. It is also possible for larger businesses to get part of the fees for consultancy work paid under the Enterprise initiative scheme.

• The Department of Employment offers business training courses through the Training Agency. They are also responsible for implementing the Business Growth Training Programme.

• Job Centres will provide you with information on training as well as the Enterprise Allowance Scheme which pays £40 per week for one year, to those who give up unemployment benefits to start a business.

• There are over 300 Enterprise Agencies around the country jointly funded by Private Companies and local government which provide assistance to business people

• The North London Business Development Agency. The Deptford Enterprise Agency and 3bs (or Black Business in Birmingham) is Enterprise Agencies funded by the Home Office to assist members of the black community in business.

• Other professional people who may be able to help you include Business and Management Consultants, who help with advice on the best way in which you can start your business and with the planning, research and preparation of your business plans.

• Accountants can help with setting up record keeping books and advise on tax planning and preparation of business plan.

• Solicitors can read over contracts and help with conveyancing • Insurance brokers can make sure that you are properly insured and let you know about employers and public liability, contract, fire, theft and loss of profit insurance. They can also give advice on medical and pension schemes. Health and safety officers will make sure that your premises are safe; if there is a Trade Association in your industry they will provide you with useful information about how to set up and operate successfully.

• Any local chamber of commerce will provide you with practical assistance and help you make contact with local business people.

[…] Source: Do You Mean Business? […]